Fed cuts again, but mortgage rates climb on 2025 inflation worries

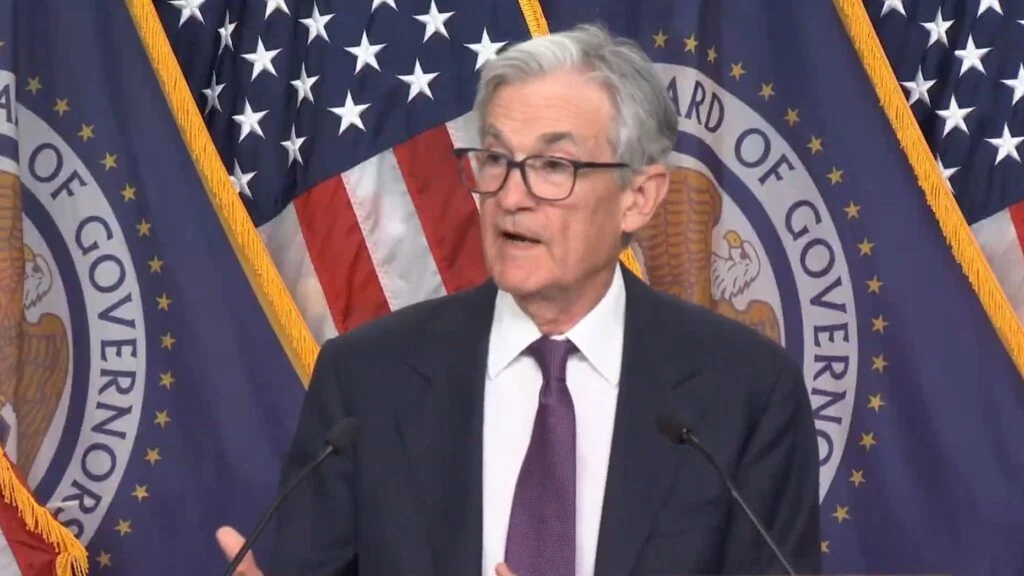

Federal Reserve policymakers approved their third rate cut of the year Wednesday but laid out a conservative path for future easing that sent long-term mortgage rates heading up on inflation worries.

The vote to cut the short-term federal funds rate by a quarter percentage point was expected, although Cleveland Fed President Beth Hammack voted against it.

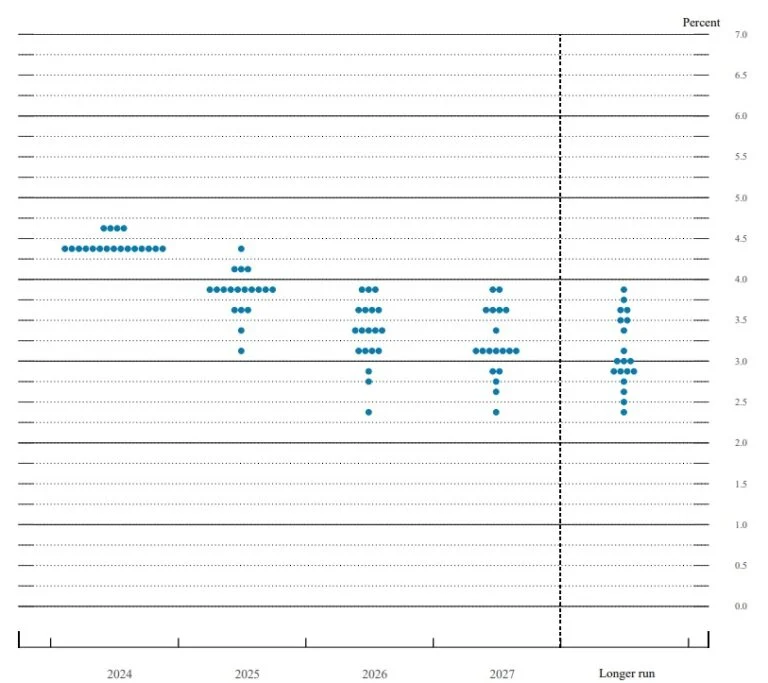

More importantly for bond market investors who fund most mortgages, the latest “dot plot” indicating where each Fed policymaker expects short-term rates to be in the years ahead showed little enthusiasm for rate cuts in 2025.

TAKE THE INMAN INTEL INDEX SURVEY FOR DECEMBER

“With today’s action, we have lowered our policy rate by a full percentage point from its peak and our policy stance is now significantly less restrictive,” Federal Reserve Chair Jerome Powell told reporters after the vote. “We can therefore be more cautious as we consider further adjustments to our policy rate.”

Yields on 10-year Treasury notes, which are a barometer for mortgage rates, climbed 11 basis points as Powell briefed reporters.

An index compiled by Mortgage News Daily showed rates on 30-year fixed-rate mortgages soaring by 21 basis points Wednesday, to 7.13 percent.

Rates for 30-year fixed-rate conforming mortgages hit a 2024 low of 6.03 percent on Sept. 17 on expectations for Fed rate cuts, according to rate lock data tracked by Optimal Blue. But once the Fed did start cutting, mortgage rates bounced back to a fourth-quarter high of 6.85 percent on Nov. 20.

“Expectations that the Fed will cut rates less than had been anticipated have been priced into the market in the form of higher 10-year Treasury and higher mortgage rates in recent weeks,” Mortgage Bankers Association Chief Economist Mike Fratantoni said in a statement.

The MBA’s forecast for mortgage rates “moved up after the election, anticipating this change and recognizing the market’s reaction to the likely path for fiscal policy and the deficit,” Fratantoni said.

MBA economists are forecasting that mortgage rates will average close to 6.5 percent over the next few years, “with significant volatility around that average.”

Mike Fratantoni

Fed ‘dot plot’ suggests cautious approach

Source: Federal Open Market Committee Dec. 18, 2024, Summary of Economic Projections

Most members of the Federal Open Market committee expect that by the end of next year, the target for the federal funds rate will be between 3.75 percent and 4 percent — just half a percentage point lower than the current level.

“The slower pace of cuts for next year really reflects both the higher inflation readings we’ve had this year and the expectation inflation will be higher,” Powell said.

The latest dot plot also shows Fed policymakers anticipate cutting rates by just half a percentage point again in 2026.

Although Fed policymakers see higher risks and uncertainty around inflation, “we see ourselves as still on track to continue to cut,” Powell said. “I think the actual cuts that we make next year will not be because of anything we wrote down today. We’re going to react to data.”

Fed has approved 3 cuts this year

After dropping short-term interest rates to zero during the pandemic to keep the economy from crashing, Fed policymakers pivoted to fighting inflation, raising the federal funds rate 11 times between March 2022 and July 2023.

Wednesday’s 25 basis-point reduction in the short-term federal funds rate is the third approved since Sept. 18, bringing the benchmark rate down a full percentage point from its post-pandemic peak of between 5.25 percent and 5.5 percent — the highest level since 2001.

“As the economy evolves, monetary policy will adjust in order to best promote our maximum employment and price stability goals,” Powell said. “If the economy remains strong and inflation does not continue to move toward 2 percent, we can dial back policy restraint more slowly. If the labor market were to weaken unexpectedly or inflation were to fall more quickly than anticipated, we can ease policy more quickly. Policy is well positioned to deal with the risks and uncertainties that we face in pursuing both sides of our dual mandate.”

‘Quantitative tightening’ to continue

To keep interest rates low during much of the pandemic, the Fed was buying $80 billion in long-term Treasury notes and $40 billion in mortgage-backed securities (MBS) every month, swelling its balance sheet to an unprecedented $8.5 trillion.

As worries about inflation began to grow in 2022, the Fed reversed course and implemented quantitative tightening.

In an implementation note, the Fed said it would continue quantitative tightening at the current reduced pace, which allows up to $25 billion in maturing Treasurys and $35 billion in mortgage-backed securities (MBS) to roll off its books each month.

But because mortgage rates are still so high that few homeowners have the incentive to refinance, the Fed’s passive approach to quantitative tightening has only allowed it to trim its MBS balance sheet by about $15 billion a month.

Source: https://www.inman.com/2024/12/18/fed-cuts-again-but-mortgage-rates-climb-on-2025-inflation-worries/