Inman

Pennymac joins Rocket in boosting conforming loan limit to $802,650

Whether it’s refining your business model, mastering new technologies, or discovering strategies to capitalize on the next market surge, Inman Connect New York will prepare you to take bold steps forward. The Next Chapter is about to begin. Be part of it. Join us and thousands of real estate leaders Jan. 22-24, 2025.

Pennymac, a major player in wholesale and correspondent mortgage lending, is following the lead of Rocket Mortgage and raising its conforming loan limits in advance of an official announcement by Fannie Mae and Freddie Mac’s federal regulator.

Pennymac TPO, which makes loans through mortgage brokers, raised its baseline conforming loan limit for single-family properties to $802,650 starting Monday Sept. 16, matching Friday’s move by Rocket TPO, Rocket’s wholesale division.

Pennymac Correspondent, which buys loans originated by correspondent mortgage lenders, said it would start pricing new locks on mortgages of up to $795,000 as if they were conforming starting Tuesday, Sept. 17.

“As a top priority of Pennymac, we’re committed to fostering success for our partners and their referral networks across the correspondent and TPO channels,” Pennymac Chief Revenue Officer Abbie Tidmore said, in a statement Tuesday. “In today’s dynamic market, where opportunities arise quickly, our strong capital base ensures that we can proactively offer increased loan amounts, giving our partners the competitive edge.”

Abbie Tidmore

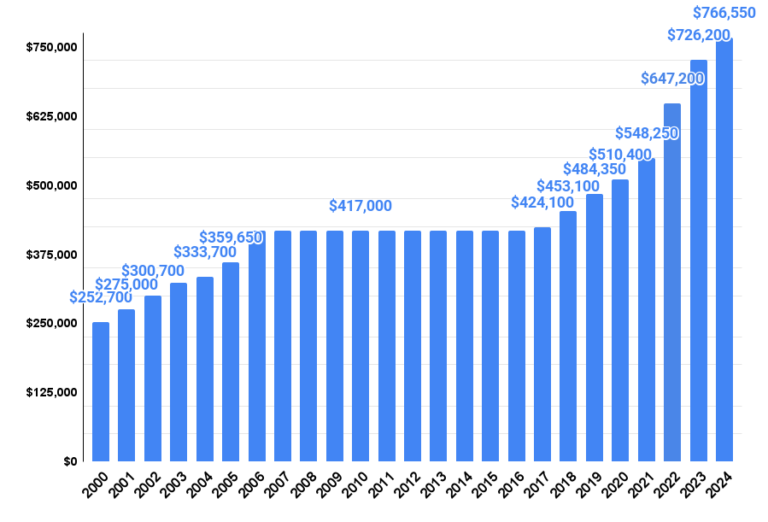

The conforming loan limit — currently $766,550 for single-family homes — caps the size of mortgages eligible for purchase and guarantee by mortgage giants Fannie Mae and Freddie Mac. Jumbo mortgages that exceed the conforming loan limit are often subject to stricter underwriting and higher down payment requirements, and borrowers typically pay higher rates.

Although the conforming limit is adjusted annually if home prices go up, the official announcement by Fannie and Freddie’s regulator, the Federal Housing Finance Agency (FHFA), doesn’t come out until November.

When prices are soaring, lenders have gotten into the habit of giving homebuyers a break by raising their limits before the official announcement. Lenders can hold the jumbo loans that they priced as conforming on their books until the new limits take effect on Jan. 1, and then sell those that are reclassified as conforming to Fannie and Freddie.

Last year Rocket, UWM and Rate all started treating loans of up to $750,000 as if they were conforming in October when the official limit was still $726,200. UWM and Rate haven’t commented on whether they’ll do so again this year.

Baseline conforming loan limit, 2000-2024

Source: Federal Housing Finance Agency.

The baseline conforming loan limit for single-family homes shot up by a record 18 percent in 2022 and by another 12.4 percent in 2023, allowing Fannie and Freddie to buy mortgages exceeding $1 million in many high-cost markets.

In higher-cost markets like Alaska and Hawaii, Fannie and Freddie are allowed to purchase bigger mortgages based on a multiple of the median home value, up to a ceiling that’s equal to 150 percent of the baseline conforming loan limit.

Congress has mandated that the conforming loan limit be tied to annual increases in FHFA’s seasonally adjusted, expanded-data House Price Index. The 2025 conforming loan limit will be based on home price appreciation during the year ending Sept. 30, 2024.

U.S. home prices rose 5.7 percent during the year ending June 30, FHFA reported on Aug. 27. So Rocket and Pennymac aren’t throwing caution to the wind in raising their conforming loan limits by 5.3 percent ahead of an official announcement.

A 5.7 percent increase in the 2025 baseline conforming loan limit for single-family homes would put it at close to $810,000 next year, Bill McBride noted in his Calculated Risk newsletter.

“However, the year-over-year increase in house prices has been slowing, and it is likely the increase will be less than 5.7 percent,” McBride noted.

Fannie Mae forecasters expect home price appreciation to slow to 3.7 percent annually in Q3 2024 and to 3 percent in the final three months of the year.

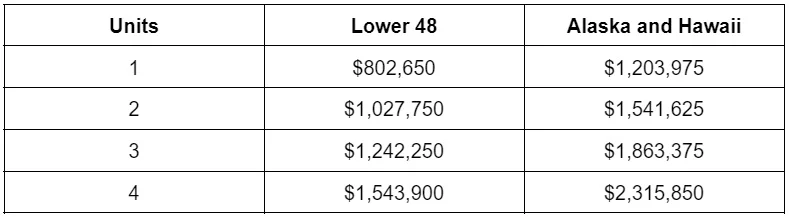

Rocket Mortgage’s new conforming loan limits

The official 2024 baseline conforming limits for multi-unit properties for 2024 are $981,500 for two-unit homes, $1,186,350 for three-unit homes, and $1,474,400 for four-unit properties.

Rocket said Friday it will treat loans on two-unit homes of up to $1.027 million in most markets as conforming, and loans of up to $1.54 million on four-unit properties.

Rocket is raising its ceiling for loans on one-unit properties to be treated as conforming in Alaska and Hawaii to $1.20 million, and to $2.31 million for four-unit properties.

While Pennymac TPO is matching Rocket TPO dollar-for-dollar, Pennymac Correspondent’s limits are slightly lower.

At $1.5 million, for example, Pennymac Correspondent’s conforming loan limit for four-unit properties is $43,900 lower than Rocket TPO and Pennymac TPO.

In higher-cost markets, Pennymac Correspondent is raising its conforming loan limit for one-unit properties to $1.175 million, and to $2.25 million for four-unit properties.

Pennymac’s correspondent lending channel accounted for 72 percent of the company’s $99.4 billion in 2023 mortgage loan production, followed by the broker direct (8 percent) and consumer direct (5 percent) channels, the company said in its most recent annual report to investors. Conventional loans fulfilled for a related company, PennyMac Mortgage Investment Trust, accounted for the remaining 15 percent.

Source: https://www.inman.com/2024/09/17/pennymac-joins-rocket-in-boosting-conforming-loan-limit-to-802650/